Lorem ipsum dolor sit amet, dolor siterim consectetur adipiscing elit. Phasellus duio faucibus est sed facilisis viverra. Umero praesent nec accumsan nibh, eu grav da metus.

Handling Payment Disputes & Chargebacks

1 min read

- What Is a Payment Dispute?

- What Is a Chargeback?

- Why Payment Disputes & Chargebacks Happen

- What Happens When a Chargeback Is Filed

- Seller Responsibility During a Chargeback

- How Dispatched by Kingston Express Protects Sellers

- Seller-Managed Orders & Chargebacks

- Possible Chargeback Outcomes

- How Chargebacks Affect Sellers

- How Sellers Can Reduce Chargeback Risk

- When to Contact Support

- Final Rule (This Matters)

(Payments & Payouts for Sellers)

A payment dispute or chargeback happens when a customer contacts their bank or payment provider to challenge a transaction.

These cases are serious — but manageable when sellers understand the process and respond correctly, especially when orders are Dispatched by Kingston Express.

This guide explains:

- What payment disputes and chargebacks are

- Why they happen

- How they are handled

- What sellers should (and should not) do

- How to reduce chargeback risk

What Is a Payment Dispute? #

A payment dispute occurs when a customer claims:

- They didn’t receive the item

- The item was not as described

- The transaction was unauthorized

📌 Disputes bypass normal refund processes.

What Is a Chargeback? #

A chargeback is a formal dispute escalated through:

- The customer’s bank

- The card issuer

- The payment provider

⚠️ Chargebacks trigger automatic reviews and temporary fund holds.

Why Payment Disputes & Chargebacks Happen #

Common reasons include:

- “Item not received” claims

- Delivery delays

- Misunderstood return policies

- Fraud or unauthorized card use

- Poor communication

📌 Many chargebacks start as preventable misunderstandings.

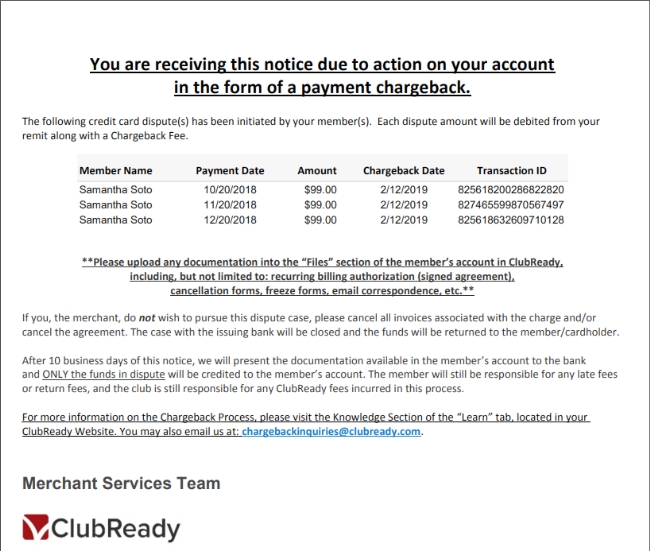

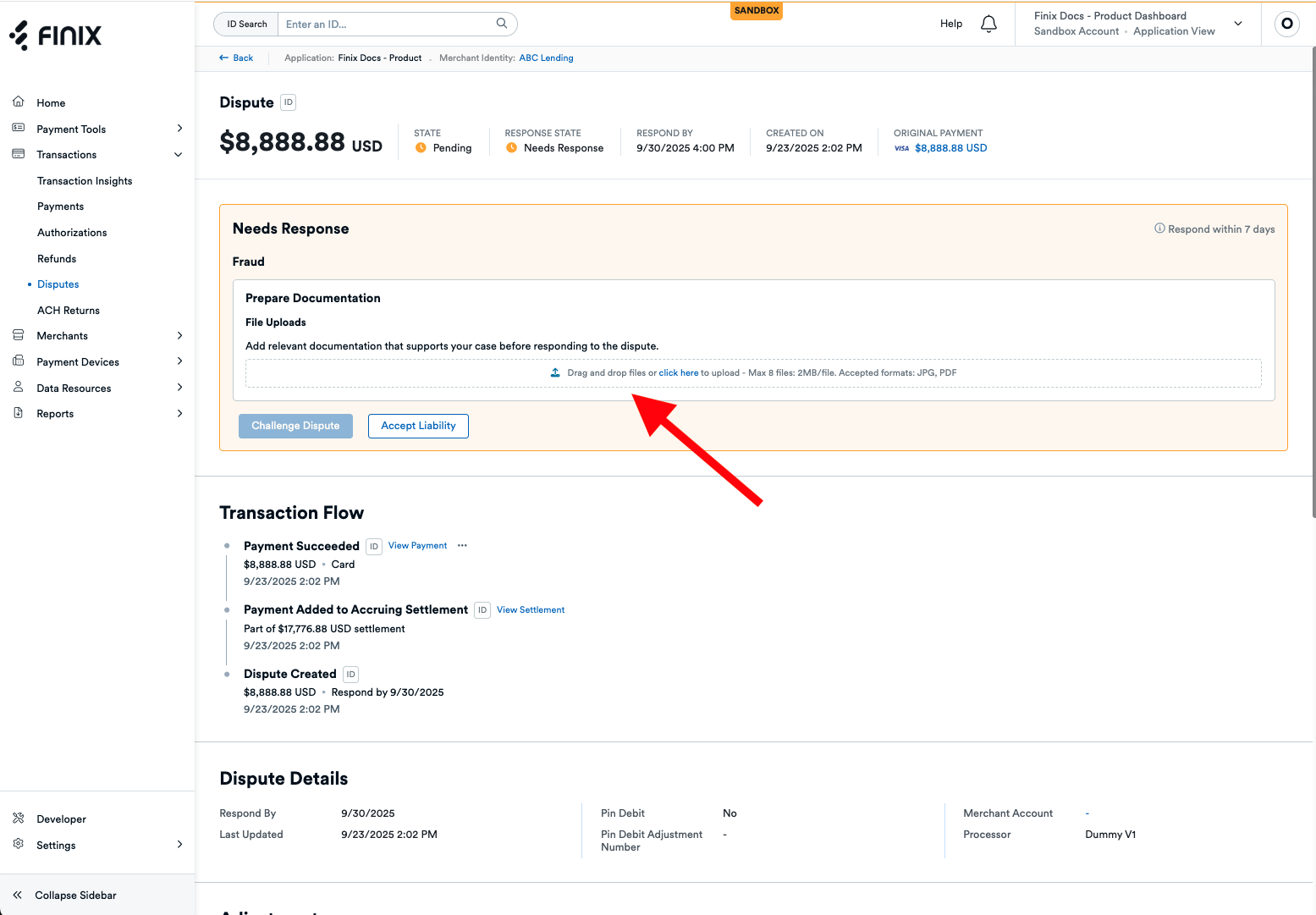

What Happens When a Chargeback Is Filed #

When a chargeback occurs:

- Funds are temporarily held

- Evidence is collected

- The case is reviewed

- A decision is issued

📊 This process is controlled by payment providers.

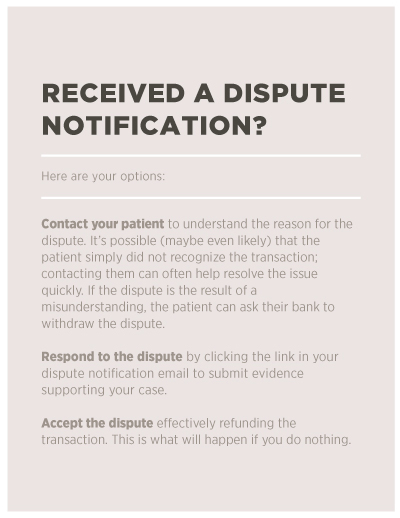

Seller Responsibility During a Chargeback #

What Sellers Should Do #

✔ Stay calm

✔ Review the order details

✔ Respond if evidence is requested

✔ Follow platform instructions

What Sellers Should NOT Do #

❌ Contact the customer directly about the chargeback

❌ Issue off-platform refunds

❌ Argue emotionally

❌ Submit false information

⚠️ Interfering can worsen the outcome.

How Dispatched by Kingston Express Protects Sellers #

For orders Dispatched by Kingston Express:

- Delivery confirmation is verified

- Tracking data is centralized

- Handling records support evidence

📦 Dispatchment significantly strengthens dispute defense.

Seller-Managed Orders & Chargebacks #

For seller-managed orders:

- Sellers may need to provide:

- Proof of delivery

- Tracking details

- Communication logs

📌 Clear documentation improves outcomes.

Possible Chargeback Outcomes #

Outcomes include:

- Chargeback reversed (seller protected)

- Chargeback upheld (funds refunded)

📊 Outcomes depend on evidence and policy.

How Chargebacks Affect Sellers #

Excessive chargebacks may:

- Delay payouts

- Affect account health

- Trigger additional reviews

📌 Occasional disputes are normal — patterns are risky.

How Sellers Can Reduce Chargeback Risk #

✔ Use Dispatched by Kingston Express

✔ Keep listings accurate

✔ Set clear delivery expectations

✔ Communicate early during delays

✔ Follow return & refund processes

📦 Prevention beats recovery.

When to Contact Support #

Contact **Kingston Express Support if:

- You receive a chargeback notice

- Evidence requirements are unclear

- A dispute outcome seems incorrect

📧 Always include the order ID.

Final Rule (This Matters) #

👉 Chargebacks are handled by evidence and process — not emotion or speed.

Sellers who:

- Follow platform rules

- Avoid panic refunds

- Rely on Dispatched by Kingston Express

…face fewer chargebacks and protect both cash flow and account health 💳📦🛡️

Jamaica

Jamaica