Lorem ipsum dolor sit amet, dolor siterim consectetur adipiscing elit. Phasellus duio faucibus est sed facilisis viverra. Umero praesent nec accumsan nibh, eu grav da metus.

Sales Tax Explained

1 min read

Sales Tax Explained #

(Buyer & Seller Help Center — Kingston Express)

Sales tax may apply to some purchases on Kingston Express, depending on the product, seller, and delivery location.

This guide explains:

- When sales tax applies

- Who charges and collects it

- How it appears at checkout

- How refunds affect sales tax

- What sellers need to know

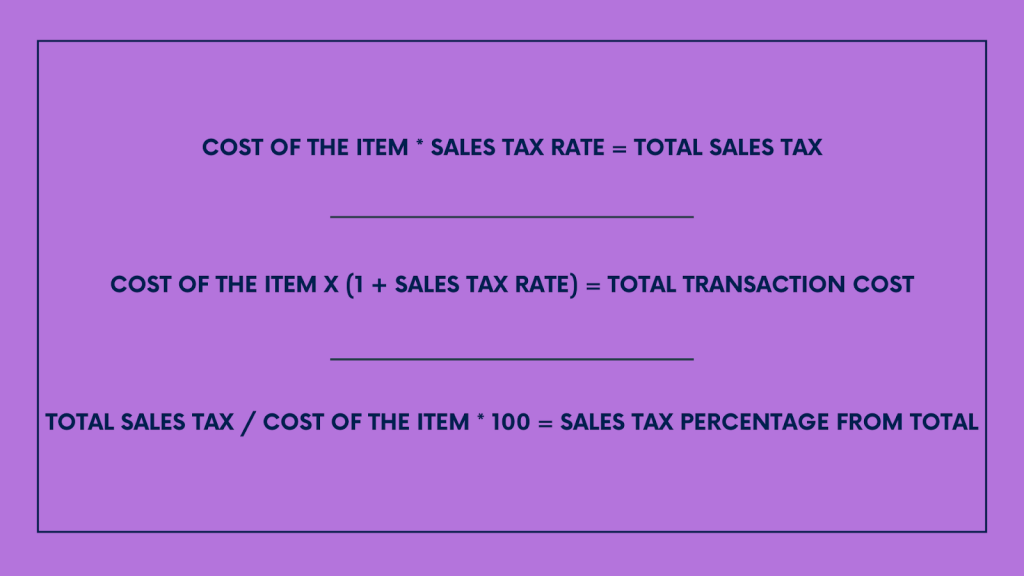

💡 What Is Sales Tax? #

Sales tax is a government-required charge applied to certain goods or services at the time of sale.

📌 It is not a marketplace fee and does not go to Kingston Express.

🛒 When Is Sales Tax Applied? #

Sales tax may apply based on:

- The type of product

- Seller tax obligations

- Buyer’s delivery location

- Local tax laws

📌 Not all products or orders are taxed.

🧮 How Sales Tax Appears at Checkout #

If applicable, sales tax will:

- Appear as a separate line item at checkout

- Be included in the order total

- Be shown before you confirm payment

📌 You will always see tax before placing the order.

👤 Who Collects Sales Tax? #

This depends on the order type:

🔹 Seller-Managed Orders #

- The seller may be responsible for tax collection

- Tax rules depend on seller registration and location

🔹 Dispatched by Kingston Express Orders #

- Tax handling may be automated

- Tax is calculated based on applicable rules

📌 Responsibility follows legal requirements, not preference.

🌍 Sales Tax on International Orders #

For international orders:

- Sales tax may not apply

- Customs duties or import taxes may apply instead

- These are usually paid by the buyer

📌 Sales tax and customs duties are different charges.

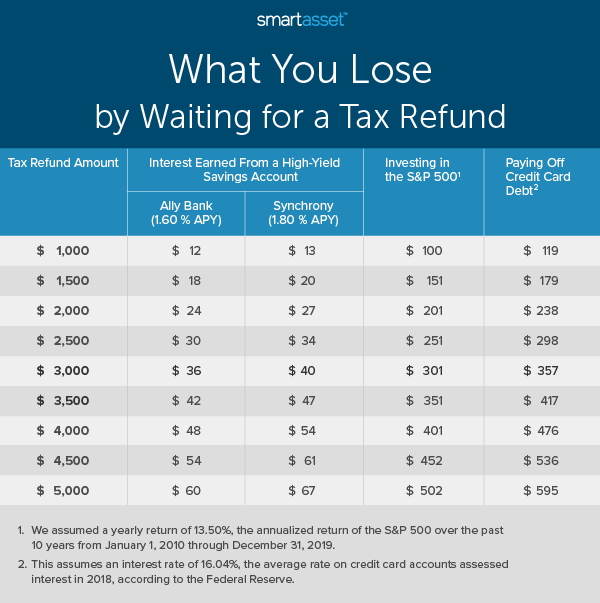

🔄 How Refunds Affect Sales Tax #

If an order is refunded:

- Any collected sales tax is refunded as well

- Partial refunds include proportional tax amounts

📌 Tax refunds follow the same method as the original payment.

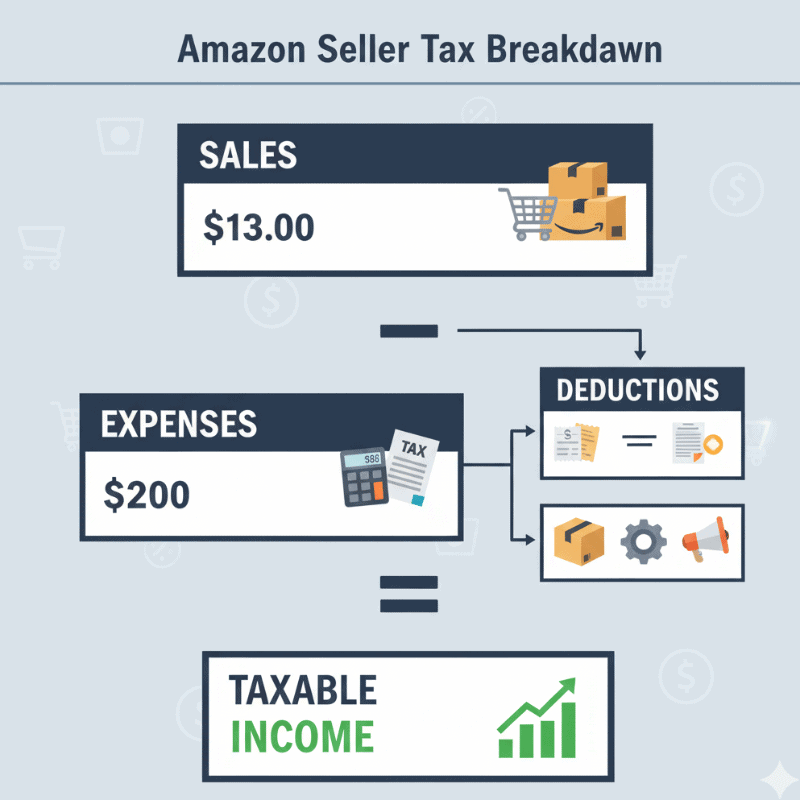

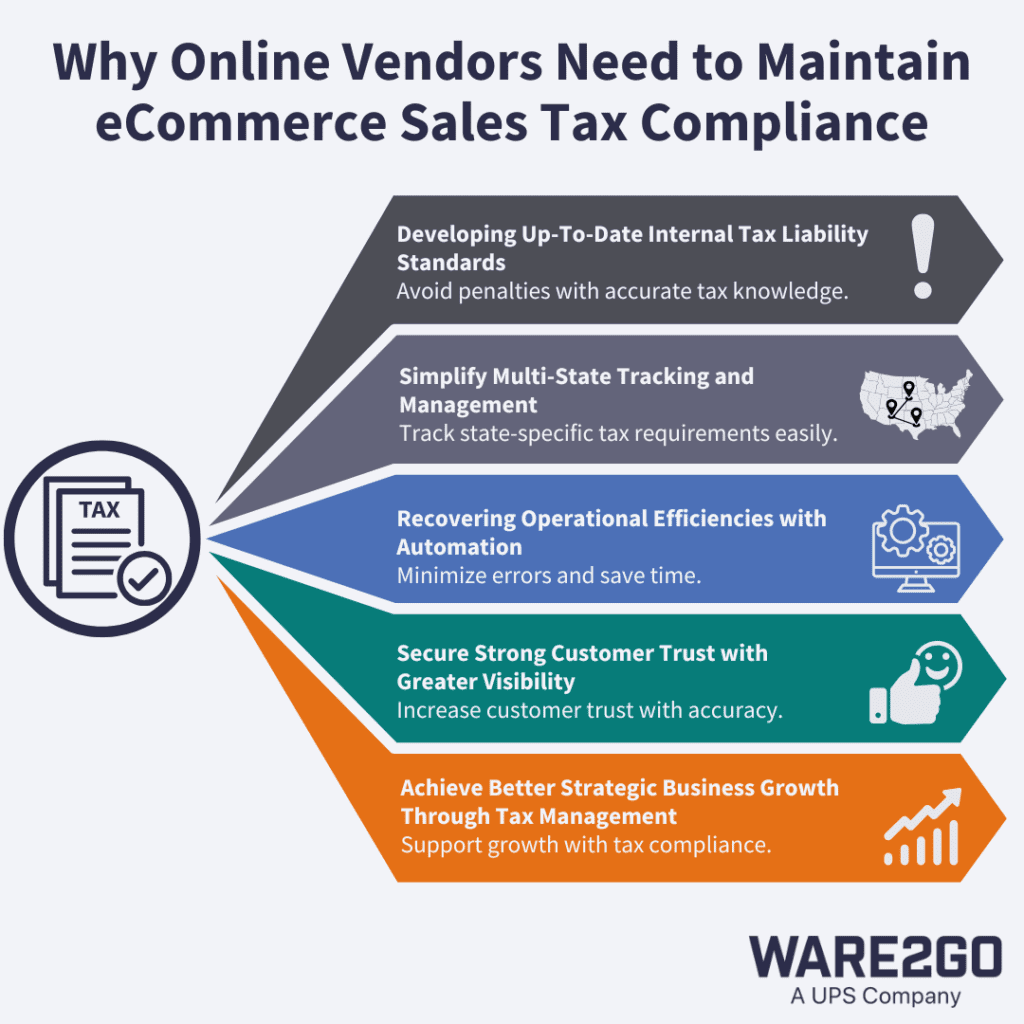

🧑💼 What Sellers Should Know About Sales Tax #

Sellers are responsible for:

- Understanding their tax obligations

- Setting up tax settings correctly

- Complying with local tax laws

📌 Kingston Express does not provide tax advice.

🛡️ Important Things to Know #

- Tax rules may change

- Tax amounts may vary by location

- Kingston Express applies tax where required

- Support cannot override tax rules

✔ QUICK FAQs #

Q: Why was sales tax added to my order?

A: Because the product or location requires it by law.

Q: Is sales tax the same as customs or import tax?

A: No. Sales tax applies at checkout; customs fees apply at delivery.

Q: Can sales tax be removed from my order?

A: No. Taxes are required by law where applicable.

Q: Will I get sales tax back if I get a refund?

A: Yes. Approved refunds include applicable tax.

Q: Does dispatchment change sales tax rules?

A: No. Tax rules are based on law, not delivery method.

🏁 Final Tip #

👉 If sales tax appears, it’s required — not optional.

Always review your order summary before confirming payment.

Jamaica

Jamaica